Your Money Matters

Every day, thousands of people fall victim to fraudulent emails, texts and calls from scammers pretending to be from their bank. The FTC reports that 2.4 million people fell victim to various financial fraud scams in 2022, totaling $8.8 billion in reported losses. Below are a few resources to help you learn how to spot, avoid and report related frauds and scams that can affect your financial well-being.

Tips from Trustar

You can never be too secure when it comes to protecting your devices and information from scammers. Here are some quick, but often overlooked, tips to help keep your financial details safe.

Popular Scams

Investment scams cost Americans $3.8 billion last year and occurs when consumers are tricked into investing money. Here are the most common scams with active links to additional information:

- Investment Coaching Scams: A scammer might lie or give fake information in an effort to have you invest in stocks, bonds, notes, real-estate, or foreign currency. Promises of providing you with an investment coach, a fool-proof strategy and an early retirement are all yours for a hefty introductory fee.

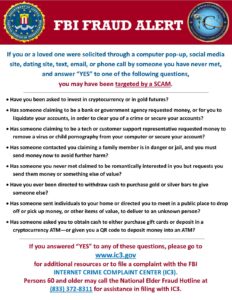

- Impersonator Scams: Romance, Social Security, Family Emergency and IRS scams are just a few imposter identities that scammers use while pretending to be someone you can trust.

- Lottery & Sweepstakes Scams: You just won a sweepstake that you didn’t even enter! This dream could be a nightmare if you are being scammed.

- Online Shopping Scams: Browsing social media can lead to more than just mindless scrolling. It could lead to impromptu purchases that expose your personal payment information for an item that you never receive.

- Business & Job Opportunities: Fake jobs touting that you can “work-from-home” or be a “virtual personal assistant” by simply applying, making sure to provide your information for direct deposit. They might even send a check for more than your sign-on bonus was supposed to be! Unfortunately, the check is fraudulent and you are now a victim.

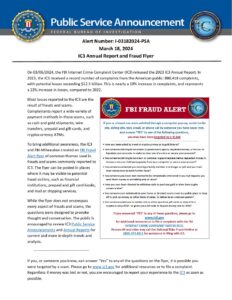

The FBI’s IC3 has additional resources, updating the public on current fraud scams. Below are recent FBI alerts and public service announcements.

Terminology

Knowledge is power and the best way to safeguard your information and finances. Here are some general descriptions of the most frequently used terms.

What to do

Do you feel that you have fallen victim to a scam? Don’t wait! Take these steps to report the crime and begin recovering what you may have lost.

- Delete any malicious software you may have downloaded.

- Immediately change all of your passwords.

- Call your credit card companies, if necessary.

- Contact your local law enforcement authorities to report the scam.

- You can also contact the Federal Trade Commission (FTC) at 1-877-FTC-HELP (1-877-382-4357) and/or the Federal Bureau of Investigation (FBI) at www.ic3.gov

Please note that active links are identified in red font and proceed to an official government resource.