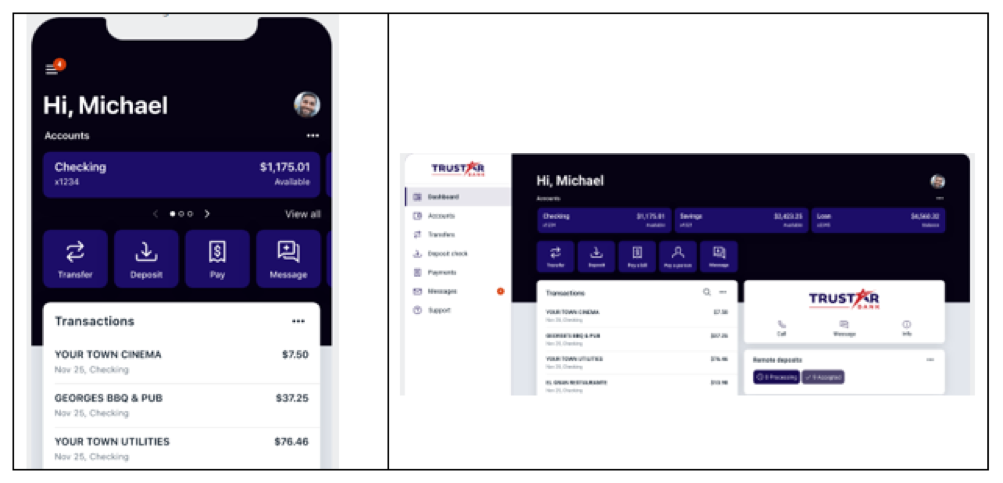

mobile banking

The Trustar Bank mobile application is your personal financial advocate that gives you the ability to aggregate your financial accounts, including accounts from various banks and credit unions, into a single view. It’s fast, secure and makes life easier by empowering you with the tools you need to manage your finances. Ensure your account is protected with a 4-digit passcode and fingerprint or facial recognition on supported devices.

To use the Trustar Bank Mobile Banking app, you must be enrolled as a Trustar Bank Internet Banking user. If you currently use our Internet Banking, simply download the app, launch it, and login with the same Internet Banking credentials.

Your Trustar Bank app can do so much more! With your Trustar mobile banking app, you can:

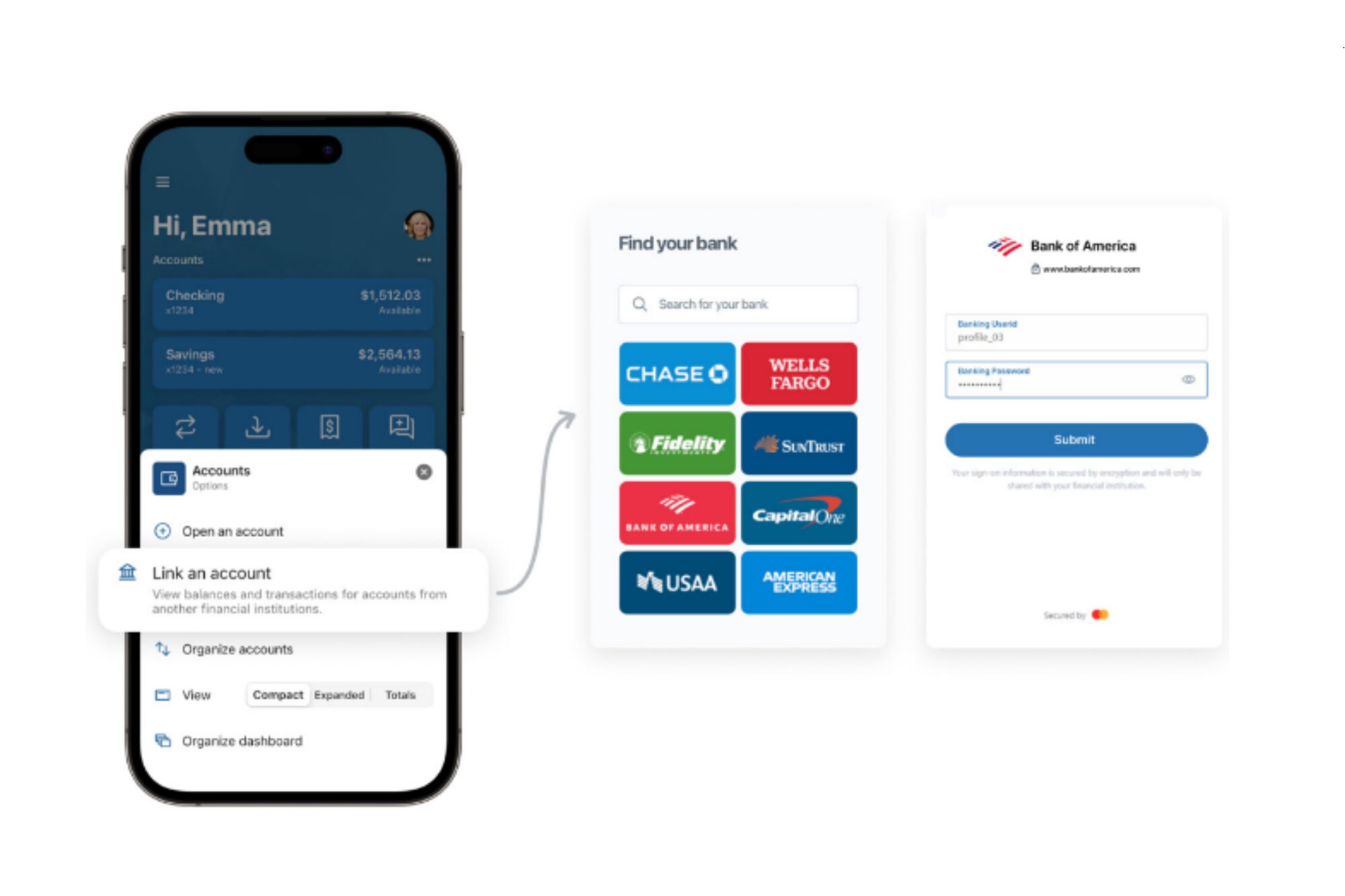

With your Trustar mobile banking app, you can consolidate all of your bank accounts and credit cards into one convenient location. View a variety of banks and account types from your Trustar Bank profile. Then, create spending and savings goals that will be automatically tracked based on the bank accounts you granted consolidated access to.

By linking accounts, you can view account balances, review transactions, and better manage your finances – all from your convenient Trustar Bank app.

The types of accounts can include the following:

The ability to consolidate the view of your accounts is included with the Trustar Bank mobile app and you can access it from the app homepage but clicking on the (+) in the main menu.

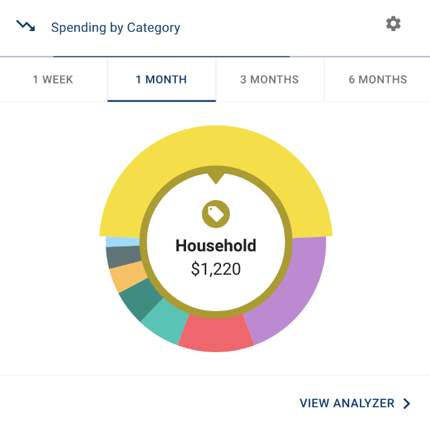

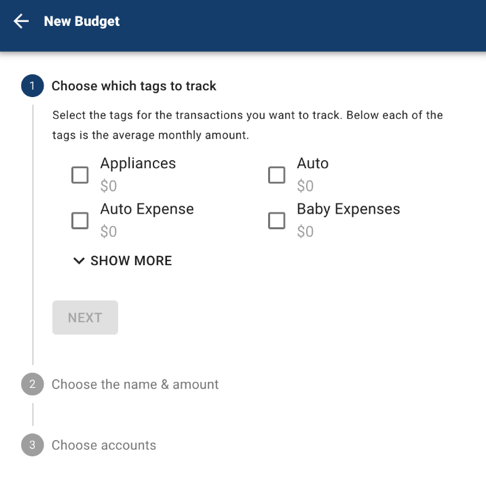

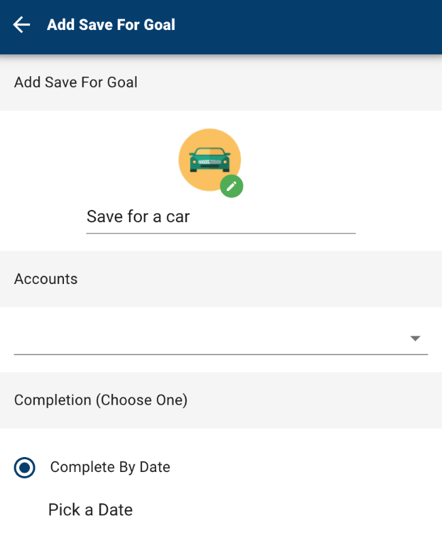

Budget Star

Budget Star is Trustar Bank’s personal financial management platform. You can use Budget Star to manage your budget and prepare for financial events with ease.

By linking accounts, you can view account balances, review transactions, and better manage your finances – all from your convenient Trustar Bank app.

This section is a supplemental privacy statement to our Privacy Policy which you received when you opened your account. This supplemental statement provides details of personal information your banking app might collect under certain circumstances and how this information is used.

Help us fight phishing fraud! Protect yourself from fraudulent emails, texts and calls from scammers pretending to be from your bank. Read some of our top tips below!