latest news

LATEST TRUSTAR BANK NEWS

The resurgence of de novos

As the number of financial institutions have dropped, the number of de novos has started to rise. The founders of three startup banks discuss the importance of community banks to the country as mission-driven organizations.

By Colleen Morrison

The June 2022 FDIC Quarterly Report pointed to a total of 4,771 insured financial institutions in the U.S., a decline of nearly 50% over the past 20 years. But this bank consolidation trend may be on the verge of being countered, at least partly, by growth in de novo banks. In fact, 2022 has a replenishment rate—the number of de novo banks opened versus those banks that have merged, closed, or failed—of 11.7%, up from just 5.2% a year ago.

“Community banks are the backbone of small business, and small business is the backbone of our country,” says Ken LaRoe, founder, CEO and chairman of the board at Climate First Bank, a $240 million-asset de novo in St. Petersburg, Fla. “To me, a banking charter is a tremendous business delivery system. We’re helping small businesses who meet our value proposition, and it’s profitable.”

And community banks themselves bring a unique value proposition to the markets they serve, says Shaza Andersen, founder and CEO of $600 million-asset de novo Trustar Bank, based in Great Falls, Va. “Bank consolidation tends to leave gaps in the market that are best served by community banks,” she says. “We were driven to start Trustar Bank by customers and employees who wanted a community bank that best served their needs rather than relying on larger institutions.”

Lauren Sparks, founder, director and CEO of $42 million-asset Agility Bank, a de novo in Houston, Texas, also emphasized the vital role community banks play in the financial infrastructure. “It’s about how important community banks are to the economy. We have to make sure we keep them relevant and available for Main Street.”

Community banks serve their customers and communities first, making them mission-driven organizations.

Shaza Andersen: Community banks serve a vital role in communities across the country. This was especially true during the pandemic, supporting the PPP [Paycheck Protection Program]. Community banks stepped up for medium and small businesses throughout the nation, helping to save jobs and businesses.

Ken LaRoe: There’s margin in the mission. I think we make more money because of our value proposition. We’re one of the fastest-growing banks in the country since 2017. Is that because of our values proposition? It’s not in spite of it, I can assure you that.

Lauren Sparks: Your bank should be your trusted advisor to help you navigate the opportunities and tools out there. The key is that the technology is part of the relationship. Striking an artful balance between technology and relationship will bring customers to your bank.

A mission-driven approach puts community banks in a unique position.

Andersen: The ability to be agile, nimble and highly responsive is the advantage that community banks have. We know our customers, our markets and the unique needs of both better than anyone. Use that to your advantage and create the best banking experience possible.

LaRoe: And your staff is a key part of it. For example, our CTO joined us after reading about us in the Tampa Bay Times. He worked for a Silicon Valley firm and wanted to join our bank because of our mission. He wrote the code for us to do a fully digitized solar loan program, including AI decisioning. Now our clients can complete an application in two and a half minutes and have an answer. Since we launched May 1 with the digital platform, we have closed $8 million in solar loans.

Sparks: There’s a lot of what we’re doing today that will change, because we will learn from it. We have unique generations of clients who don’t speak the same language, and some will not consider channels that others will, so it’s about being agile. We have the opportunity to keep reinventing ourselves. It’s a different world, and it’s exciting to be in banking now.

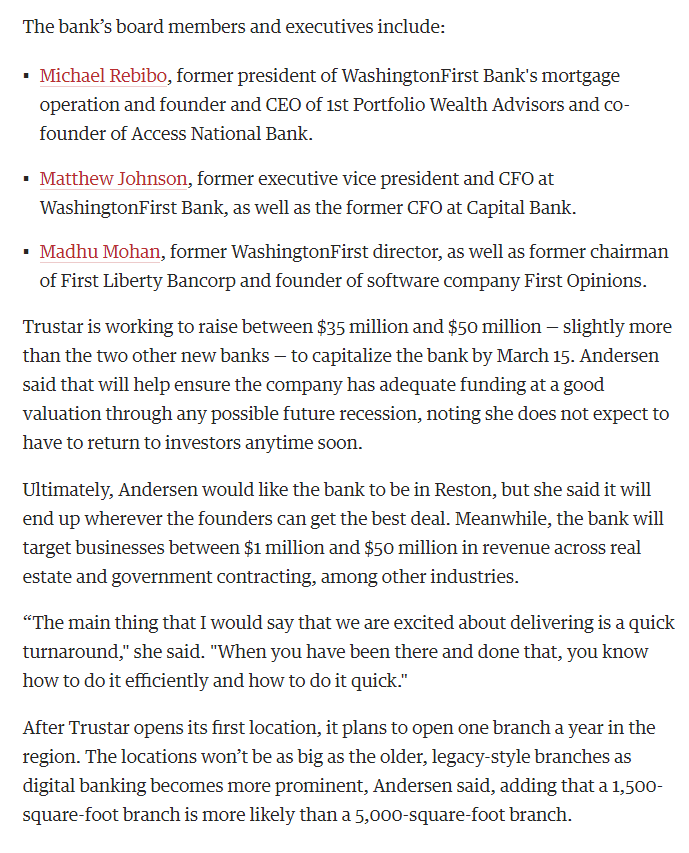

Corporate Philanthropy List - Small Companies by Giving in Greater D.C.

By Carolyn M. Proctor, Washington Business Journal

Ranked by Metro-area giving

Trustar Bank is honored to be recognized by the Washington Business Journal as #6 on their “Corporate Philanthropy – Small Companies by Giving in Greater D.C.” list. The list ranks the top 10 most charitable companies in the DC metro area, ranked by total donations in 2021. Trustar Bank prides itself in giving back to the community in which it serves and thanks the Washington Business Journal for this wonderful honor!

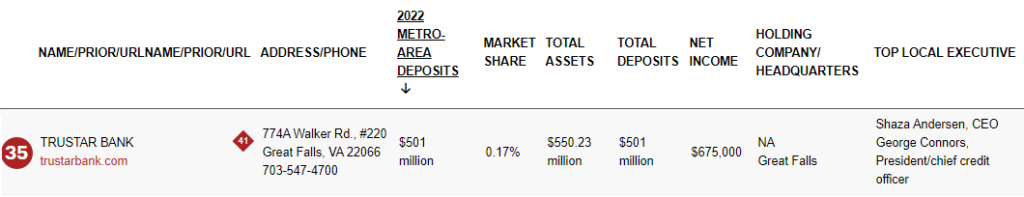

Largest Banks and Thrifts in Greater D.C.

By Carolyn M. Proctor, Washington Business Journal

Ranked by 2022 metro-area deposits

Trustar Bank has made the Washington Business Journal’s list of the the Largest Banks and Thrifts in the D.C. area!

Here it is: The Washington Business Journal's Power 100 class of 2022

Power has been redefined in the last two-plus years.

It’s not merely how much money one controls, or the size of one’s network.

With that in mind, we are revealing our Power 100 this year. As you go through this list, you will see some familiar names, but also, hopefully some names you have yet to stumble across or add to your modern-day rolodex. Names you can perhaps partner with, fund, hire or even acquire to reach a bigger or more inclusive audience.

You’re not going to agree with this entire list. You’ll think of more folks we should have included. If it’s any comfort, we have more folks we wish we could have included. This list is the result of very difficult decisions. In some cases, we chose contenders based on their scale. For others, it was their quiet, on-the-ground ripple effects. In others, we tried to mix things up from prior years. Sometimes it’s not the highest-ranking person at the business, but instead the executive with the greatest interaction with those the business serves.

They’re all people you should know — to better your organization, your headquarters, your workforce or your contribution back to the community.

In many cases, their power is redefined by how they reshape our full community, how they bridge gaps, and how they make the lives of others better, enabling them to reach their top potential.

But I’m sure you have thoughts about this list — feel free to email them to me at vsinha@bizjournals.com. There’s still more power to be shared next year.

Shaza Andersen, founder and CEO, Trustar Bank

Shaza Andersen is creating another formidable community bank in the D.C. region. The former CEO at WashingtonFirst Bank, which she took public in 2012 and built into a top local bank before selling it to Sandy Spring Bancorp in 2018, founded Trustar Bank in Falls Church in 2019. In three short years, the bank has more than quintupled its assets, to $550 million, and it just raised another $18 million in an oversubscribed private placement and will use the proceeds to help fund its continued expansion.

Trustar Bank in Great Falls raises $18 million to fund continued expansion

By Alan Kline Senior Editor, Washington Business Journal

Trustar Bank is wasting no time putting the capital it recently raised to work.

The Great Falls bank announced Friday it has opened its first branch in D.C. at 1701 Pennsylvania Ave. NW. The branch is Trustar’s fifth, joining its other locations in Great Falls, Reston, Tysons and Potomac.

The new D.C. office will be open from 9 a.m. to 5 p.m. Monday, Wednesday and Friday and by appointment on Tuesday and Thursday. The community bank primarily serves small- and midsize businesses, though mortgage lending has become a bigger focus since it acquired a Fairfax mortgage company in late 2020.

“Our D.C. location will allow us to serve new and current clients who work or reside in D.C.,” Andersen said in a statement. “We’re excited to offer an in-person banking experience for our D.C.-based customers and look forward to continuing our growth and expansion throughout the Greater Washington market.”

Andersen is the former CEO at WashingtonFirst Bank in Reston, which she took public in 2012 and built into a $2.1 billion-asset bank before selling it to Olney’s Sandy Spring Bancorp in 2018 for $447 million.

She began organizing Trustar in early 2019 and the bank opened for business in July of that year. It was the first new bank to open in Virginia in more than a decade and since then it has more than quintupled its assets, to about $560 million. Trustar has been profitable since the second quarter of 2021, according to Federal Deposit Insurance Corp. data.

Trustar Bank Announces First Branch in Washington, D.C.

August 26, 2022–GREAT FALLS, Va.–(BUSINESS WIRE)–Trustar Bank has announced the opening of its newest branch location, and first in Washington, D.C, at 1701 Pennsylvania Ave, NW Suite 200, Washington, D.C. 20006.

This Pennsylvania Avenue location offers our clients in the District the convenience and service they have come to know and expect from Trustar Bank. The new location is open on Mondays, Wednesdays, and Fridays from 9:00 AM to 5:00 PM and by appointment on Tuesdays and Thursdays.

“Our D.C. location will allow us to serve new and current clients who work or reside in D.C.,” commented Shaza Andersen, Chief Executive Officer and Founder. “We’re excited to offer an in-person banking experience for our D.C.-based customers and look forward to continuing our growth and expansion throughout the Greater Washington market.”

Pennsylvania Avenue is the fifth Trustar Bank branch to open since the Bank launched in 2019, joining the Great Falls, Reston, and Tysons, VA and Potomac, MD branches. Trustar Bank has expanded rapidly in these three short years, with plans to continue a high rate of growth in the years to come.

About the Bank – Trustar Bank is a full-service bank offering comprehensive banking products and services to small- and medium-sized businesses and consumers. It is the first bank to be chartered and opened in Virginia in over a decade. For more information, please visit Trustar Bank online at trustarbank.com.

Contacts

Media:

Shaza Andersen

Chief Executive Officer

sandersen@trustarbank.com

Anthony Fabiano

Chief Financial Officer

afabiano@trustarbank.com

Trustar Bank CEO, Shaza Andersen, Appointed to Board of Commissioners of the Virginia Port Authority by VA Governor Glenn Youngkin

GREAT FALLS, Va.–(BUSINESS WIRE)–Shaza Andersen, founder and Chief Executive Officer of Trustar Bank in Great Falls, VA, has been appointed to the Board of Commissioners of the Virginia Port Authority by Virginia Governor Glenn Youngkin. Ms. Andersen will serve a five-year term effective July 1, 2022 through June 30, 2027.

A favored and sought-after authority on leadership, banking, and capital market issues, Ms. Andersen is eager to bring her expertise and talents to the Virginia Port Authority Board. She was selected for the honor along with three other Virginia leaders. “I’m proud to appoint these dedicated individuals,” said Governor Glenn Youngkin. “Their work will move our Commonwealth into the future and help create a best-in-class government.”

About the Bank – Trustar Bank is a full-service bank offering comprehensive banking products and services to small- and medium-sized businesses and consumers. It is the first bank to be chartered and opened in Virginia in over a decade. For more information, please visit Trustar Bank online at trustarbank.com.

Contacts

Media:

Shaza Andersen

Chief Executive Officer

sandersen@trustarbank.com

Anthony Fabiano

Chief Financial Officer

afabiano@trustarbank.com

Trustar Bank in Great Falls raises $18 million to fund continued expansion

By Alan Kline Senior Editor, Washington Business Journal

Three-year-old Trustar Bank in Great Falls has raised $18 million in fresh capital and intends to use the proceeds to help fund its expansion across the D.C. region.

The private placement, which was oversubscribed and completed in less than a month, could be a prelude to an eventual initial public offering for the $560 million-asset Trustar. Its founder and CEO, Shaza Andersen, is the former CEO at WashingtonFirst Bank, which she took public in 2012 and built into a $2.1 billion-asset bank before selling it to Sandy Spring Bancorp in Olney for $447 million.

Trustar was the first new bank chartered in Virginia in more than a decade when it opened its doors in July 2018. It has more than quintupled its assets since then and has been profitable since the second quarter of 2021, according to Federal Deposit Insurance Corp. data.

The bank opened its fourth branch in Potomac last year, to go along with its three in Northern Virginia, and has filed an application to open a fifth in D.C., Andersen said in an interview.

Trustar primarily serves small and midsize businesses, though its mortgage business has grown steadily since it acquired Fairfax’s Granite Mortgage in late 2020. Mortgages accounted for about 28% of its total loans at March 31, up from 21% a year earlier, according to FDIC data, and have helped to boost fee income.

Andersen said that Trustar had set out to raise between $7.5 million and $15 million and ultimately pulled in about $20.5 million, largely from individual investors. Its board opted to accept $18 million, so the difference was returned to subscribers, Andersen said.

It marked the second time in Trustar’s short history that a capital raise was oversubscribed. The bank opened for business in 2019 with about $50 million in capital, $15 million above its initial fundraising target.

2022 Leukemia Ball Presented by Trustar Bank to Feature Comedy from Roy Wood Jr. and Music by The Legwarmers

April 28, 2022 (Washington, DC) – Celebrating more than three decades as one of the Washington, D.C. area’s most widely recognized and revered charity events, the Leukemia Ball is scheduled for Saturday, June 18, 2022. Taking place at the Marriott Marquis Washington D.C., this event is dedicated to raising money for life-saving cancer research and patient programs funded by The Leukemia & Lymphoma Society (LLS). Since the first Leukemia Ball in 1987, the event has raised more than $68 million toward the LLS mission to cure leukemia, lymphoma, Hodgkin’s disease and myeloma and improve the quality of life for patients and their families. As a testament to everything LLS has accomplished with its supporters, the theme for our 2022 Leukemia Ball is Legacy. LLS would like to thank our 2022 Presenting Sponsor, Trustar Bank, as well as Comedy Sponsor, PwC, and Music Sponsor, BDO.

Guests at the 2022 gala will enjoy entertainment from Roy Wood Jr., correspondent on Comedy Central’s Emmy-nominated The Daily Show with Trevor Noah. Roy Wood Jr. is a talented comedian and actor who has collaborated on two podcasts, Roy’s Job Fair and Beyond the Scene.

Roy Wood Jr. has also worked as an Executive Producer of the PBS documentary The Neutral Ground, an HBO Max project 1% Happy and an untitled medical field comedy for NBC. Wood will executive produce, write, and star in an untitled single-camera comedy about the National Guard in works at FOX, with Denis Leary producing it for television. In theatres, Wood will star alongside Jon Hamm in the long awaited Fletch remake, Confess, Fletch, currently in production.

Wood has entertained millions across stage, television, and radio. Forbes declared he is “One of comedy’s best journalists,” Entertainment Weekly has described his thought-provoking comedy as “charismatic crankiness” and Variety Magazine named him “One of 10 Comics to Watch in 2016.” Before The Daily Show, Wood co-starred for three seasons on TBS’s Sullivan & Son, and he remains a regular guest on various ESPN shows and the MLB Network.

During the global pandemic, Wood spent time raising money for displaced staff of comedy clubs. He is also involved in other philanthropic endeavors in his hometown of Birmingham, Alabama, focused on enriching the lives of people with disabilities and employment barriers as well as increasing the literacy rates in children of color by engaging them in literature that reflects their culture and image.

The crowd will also dance the night away to the sounds of The Legwarmers, DC’s Ultimate 80’s Tribute Band. From the Simmons electronic drum kit to the checkered vans and skinny ties, the Legwarmers are the eighties everyone remembers and wants to relive. The Legwarmers are comprised of Chet Reno – Bass/ Vocals, Johnny Phoenix – Guitar/ Vocals, Roxanne “Roxy” Rio – Vocals, Gordon Gartrell – Guitar/Vocals, Lavaar Huxtable – Drums, Capt. Morgan Pondo – Keyboard, and Clarence McFly – Tenor Sax. Leukemia Ball guests will not be able to stay in their seats during the performance from these local legends.

In addition to top-notch entertainment, the Leukemia Ball also features an unparalleled live and silent auction, featuring a variety of travel, D.C. sports and entertainment, and luxurious wine and dine packages.

The 2022 Leukemia Ball is co-chaired by Shaza Andersen, CEO of Trustar Bank, Terri McClements, Senior Partner at PwC, and Kevin Smithson, Managing Partner at PwC. They lead an esteemed volunteer Executive Committee of more than thirty high-ranking executives representing major organizations across the D.C. area, who volunteer their time and efforts to create a memorable evening and raise millions of dollars in support of LLS’s mission.

“LLS is changing the landscape of cancer research now more than ever. In 2021, LLS helped advance nearly half of blood cancer treatment options approved by the FDA,” said Ria Freydberg, Mid-Atlantic Region Executive Director. “The funds raised through events such as the Leukemia Ball over the past

35 years have significantly contributed to these unprecedented developments in research. These advances are providing blood cancer patients with new, innovative, and more effective therapies.”

LLS has been on the forefront of advances in blood cancer treatment since 1949. Over the last five years, LLS helped advance 75% of the almost 100 FDA-approved blood cancer treatment options. However, the fight is not over. Nearly one-third of all blood cancer patients still do not survive five years past diagnosis. That is why the goal for the 2022 Leukemia Ball is to raise $2.6 million for this worthy cause, which is made possible by the generous sponsors and supporters of this event. LLS is especially grateful to the event’s Presenting Sponsor, Trustar Bank, Comedy Sponsor, PwC, Music Sponsor, BDO, longtime Partner In Hope, LiUNA, along with other top sponsors including Genentech, Merck, Pharmacyclics, Truist, Bristol Myers Squibb, and Official Airline Sponsor American Airlines.

The event emcees will be Angie Goff and Guy Lambert, both anchors on FOX 5 DC. LLS would like to thank their media partners; Comcast, FOX 5 DC, LINK Strategic Partners, 97.1 WASH-FM, Washingtonian, and WTOP.

A variety of sponsorship opportunities for the 2022 Leukemia Ball are available. For more information, please contact Allie Krafft at Allie.Krafft@lls.org or call 703-399-2910.

About The Leukemia & Lymphoma Society

The Leukemia & Lymphoma Society’ (LLS) is a global leader in the fight against cancer. The LLS mission: Cure leukemia, lymphoma, Hodgkin’s disease, and myeloma, and improve the quality of life of patients and their families. LLS funds lifesaving blood cancer research around the world, provides free information and support services, and is the voice for all blood cancer patients seeking access to quality, affordable, coordinated care. Founded in 1949 and headquartered in Rye Brook, NY, LLS has regions throughout the United States and Canada. To learn more, visit www.LLS.org. Patients should contact the Information Resource Center at (800) 955-4572, Monday through Friday, 9 a.m. to 9 p.m. ET. For additional information visit lls.orq/lls-newsnetwork. Follow us on Facebook , Twi tter, and lnstagram.

About The Mid-Atlantic Region

LLS serves twenty-seven regions, and the Mid-Atlantic is one of the highest revenue-generating regions in the nation. The Mid-Atlantic region serves Washington, D.C.; Maryland; and the Virginia Counties of Loudoun, Fairfax, Arlington, Alexandria, and Prince William. In 2021 LLS invested $4,244,000 in co-pay assistance to patients in the Mid-Atlantic region, served 1,060 new patients by Education and Services, and had 434 patients receive assistance through the COVID-19 Patient Aid program. Find us on Facebook and lnstagram. #Leukemia Ball #FightBloodCancer

Trustar Bank Raises $18 Million in New Capital in Latest Stock Offering

July 20, 2022–GREAT FALLS, Va.–(BUSINESS WIRE)–Trustar Bank is pleased to announce the successful completion of its recent capital raise. In less than a month’s time, the offering surpassed its initial $15 million goal, resulting in an over-subscription of 36% and over $20 million in received subscriptions. To accommodate the overwhelming investor support, the offering will be “up-sized” by approximately 20%, for a total capital raise of $18 million. This is the Bank’s second oversubscribed stock offering, the first taking place prior to the Bank’s inception in early 2019.

“We are excited to have the continued investor support affording us the opportunity to build an outstanding financial institution serving the needs of our community. This new capital will further position the Bank to effectively implement our growth strategy and build stockholder value,” CEO Shaza Andersen said.

About the Bank – Trustar Bank is a full-service bank offering comprehensive banking products and services to small- and medium-sized businesses and consumers. It is the first bank to be chartered and opened in Virginia in over a decade. For more information, please visit Trustar Bank online at trustarbank.com.

Media Contacts

Shaza Andersen

Chief Executive Officer

sandersen@trustarbank.com

Anthony Fabiano

Chief Financial Officer

afabiano@trustarbank.com

These are the Best Places to Work in Greater Washington in 2022

As Greater Washington continues on its path to recovery from the Covid-19 pandemic, the Washington Business Journal is honoring 75 local companies for ranking as the Best Places to Work in our region.

These 75 companies scored highest among hundreds of employers that participated in Omaha, Nebraska-based Quantum Workplace’s employee engagement survey.

Rankings of the Best Places to Work honorees will be announced at an awards ceremony May 12 at the Hilton McLean Tysons Corner and in the May 13 issue of the Washington Business Journal. For more information on the event, click here.

How did these honorees make the list? Nominated businesses meeting criteria for business location and size are invited to participate in employee engagement surveys distributed by Quantum Workplace. Based on the results of those surveys, businesses are assigned a score out of 100 percent and ranked by Quantum. The top-rated companies in four size categories — small, medium, large and extra-large — are honored by the Business Journal as Best Places to Work.

Check out our full list of Best Places to Work winners — in alphabetical order — below.

SMALL (10 to 24 employees)

- ADVI Health LLC

- Capitol PResence

- Cohen Seglias Pallas

- Greenhall & Furman PC

- Cope Corrales

- Defense Trade Solutions

- Glassman Wealth Services

- growth[period]

- hyrUP

- Iberia Advisory LLC

- Lovelytics

- Main Digital LLC

- Matrix Consulting

- Milrich Virtual Professionals LLC

- ROCS Grad Staffing

- Stanton Communications Inc.

- TaylorMade Experience

- TorchLight Hire

- Vertosoft LLC

- VWG Wealth Management LLC

- West, Lane & Schlager Realty Advisors

- ALKU

- Bridge Core LLC

- C3 Integrated Solutions

- Cloudforce

- Dupont Circle Solutions

- Fraym

- Hive Group LLC

- KLIK

- Loansteady

- McKinley Advisors

- Nuvitek

- QBE LLC

- SEI

- Spartan Medical

- Steward Partners

- Tellius

- The HeadFirst Companies

- The Midtown Group

- Trustar Bank

- Valiant Solutions LLC

- ADI Construction

- Anavation LLC

- Black Cape Inc.

- BTI360

- Case Consulting

- Cassaday & Co. Inc.

- CENTURY 21 Redwood Realty

- Changeis Inc.

- Coakley & Williams

- Construction

- Curbio

- D&G Support Services

- Full Visibility LLC

- Harrity & Harrity LLP

- iDirect Government

- IntraFi Network LLC

- JRC Integrated Systems

- M2 Strategy

- MarginEdge

- MassMutual Greater Washington

- McLean Mortgage Corp.

- MetaPhase Consulting

- Old Dominion National Bank

- PhoenixTeam

- Seventh Sense Consulting LLC

- Significance Inc.

EXTRA-LARGE (250+ employees)

- Aronson LLC

- Boland

- George Mason Mortgage LLC

- James G. Davis Construction Corp.

- Kearney & Company

- NFP

- Salesforce

- Science Systems and Applications Inc.

- Van Metre Companies

- Wondrium

Founder and CEO of Trustar Bank Shaza Andersen to speak at Winter Graduation 2021

Graduation ceremonies will take place at 10 a.m. and 2 p.m. on Thursday, Dec. 16, at EagleBank Arena on the Fairfax Campus.

Andersen, BA Area Studies ’89, founded Trustar, the first community bank to be chartered in Virginia in more than 10 years when it opened in 2019. She is the former vice chair of the board of Sandy Spring Bank and prior to that was founder and CEO of WashingtonFirst Bank.

Andersen, who serves on the Mason School of Business Dean’s Advisory Council, is one of 18 members nationally on the FDIC Advisory Committee on Community Banking. In 2010, then-Virginia Gov. Bob McDonnell appointed Anderson to Virginia’s Treasury Board.

Twice named a Top Banker by SmartCEO Magazine, Andersen also has been named one of the Top 100 Powerful Women by Washingtonian. The Washington Business Journal has twice listed her among both its Power 100 and 50 Fastest Growing Companies, as well as among its Women Who Mean Business and Most Admired CEO lists.

Andersen founded the Trustar Youth Foundation (formerly the WashingtonFirst Youth Foundation), a local not-for-profit organization dedicated to children’s causes.

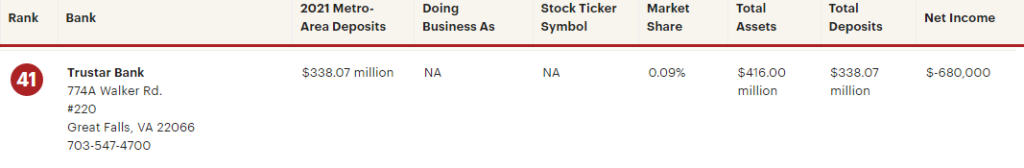

Largest Banks and Thrifts in Greater D.C.

By Carolyn M. Proctor, Washington Business Journal

Ranked by 2021 metro-area deposits

Trustar Bank has made the Washington Business Journal’s list of the the Largest Banks and Thrifts in the D.C. area!

Finalists Announced for 21st Annual March of Dimes Heroines of Washington Awards

Arlington, Va. | September 01, 2021 09:05 AM Eastern Daylight Time

March of Dimes has announced the finalists for its 21st Annual Heroines of Washington Awards. The Heroines of Washington Awards, presented by Peraton, recognize and honor professional women in the D.C. Metro area for their dedication to community service. The March of Dimes Heroines of Washington Awards gala will take place in person on Tuesday, November 16, 2021, from 6:00–9:00 pm at the Ritz-Carlton Tysons Corner.

This year’s finalists represent a diverse group of women who continued their commitments to volunteerism in addition to their successful careers during a year with tremendous challenges brought on by the COVID-19 pandemic. The women nominated and awarded come from a variety of industries including healthcare, real estate, the public sector, and more.

2021 Heroines of Washington Finalists:

Hilah Zia, Children’s National Hospital

Lydia Russo, Lydia Real Estate

Daniela Fiore, Carahsoft

Stephanie Kinsey, Cognosante

Sarah Kinling, The MITRE Corporation

Sandy L. Chung, Health Connect IPA

Beth Robertson, NFP

Julia Fantacone, Altarum

Carly Mitchell, Guidehouse

Kerry-Ann Hamilton, KAH Consulting Group

Shaza Andersen, Trustar Bank

Debbi Jarvis, Howard University

Nicole Monteforte, Booz Allen Hamilton

Meredith Mark, PwC

Liz Jones, Northampton School District

Irma Becerra, Marymount University

Selvi Clark, Booz Allen Hamilton

Nancy Bossard, Long and Foster

Lisa Benjamin, Newmark Knight Frank

Chaise Schmidt, Cushman & Wakefield

Kymber Lovett-Menkiti, Keller Williams Capital Properties

Dr. May Kinnard-Brown, The MITRE Corporation

Ashley Irwin, SolarWinds

Judy Douglas, Peraton

Michele Bolos, NT Concepts, Inc.

“Every year I continue to be amazed by the professional women in the DMV who continue to go above and beyond to support our community,” said Jennifer Felix, ASRC Federal president and CEO. “In a year fraught with extremely difficult circumstances, volunteers were truly a shining light, and the March of Dimes Heroines of Washington Awards is one of the few opportunities for us to celebrate their incredible work.”

This year’s awards mark a return to the Heroines of Washington’s in-person gala. All finalists will be honored, and winners will be announced during the gala event on Tuesday, November 16, 2021, from 6:00 – 9:00 pm at the Ritz-Carlton Tysons Corner.

Along with the awards presentation at the gala, there will be a dinner and silent auction. Guests will include directors, CEOS and other high-level individuals and leaders from local organizations, businesses and government. Event sponsors include Peraton, ASRC Federal, M&T Bank, PwC, ManTech, KPMG, and Carahsoft.

All funds raised by the Heroines of Washington Awards help support March of Dimes programs, research, community services, education and advocacy to advance research that supports the health of all moms and babies. Since 2001, March of Dimes has honored over 126 “Heroines” and raised more than $3.6 million to support the March of Dimes mission.

For tickets or to learn more about the awards gala, please visit: marchofdimes.org/heroines.

About March of Dimes

March of Dimes leads the fight for the health of all moms and babies. We support research, lead programs and provide education and advocacy so that every baby can have the best possible start. Building on a successful 80-year legacy of impact and innovation, we empower every mom and every family. Visit marchofdimes.org or nacersano.org for more information. To participate in our annual signature fundraising event, visit marchforbabies.org. Visit shareyourstory.org for comfort and support. Find us on Facebook and follow us on Instagram and Twitter.

Contact Details

Emily Ergas (Sage Communications)

+1 972-261-4306

Bevan Bello (March of Dimes)

+1 571-257-2300

Company Website

Washington’s Most Powerful Women 2021

Our list of the region’s 150-plus most powerful women includes hometown heavyweights, national notables, and folks shaping things from the arts to medicine to the economy.

Power in Washington is a complicated thing to quantify. Some people have it by virtue of the office they hold. Others maintain it by virtue of their reputations, no matter what their business card might read. And in a political city, many of the most powerful among us owe their clout to voters—either the constituents who elect them directly or the national electorate who picks the government every four years.

That last factor is a reason why this year’s Most Powerful Women list is replete with new names—not only did the government change, but the new administration put a lot more women into top jobs, starting with the vice-presidency.

Of course, not all power resides in high-profile arenas like politics. Some of the most powerful women on our list might be able to walk down Pennsylvania Avenue unnoticed—while still causing people to tremble in whatever other world they help shape.

[…]

Business Powers

Shaza Andersen, founder and CEO of Trustar Bank. She leads the first new DC-area bank to open in more than a decade.

These are the 75 Best Places to Work in Greater Washington for 2021

Our 15th annual Best Places to Work comes at a time that has tested business owners and employees all across Greater Washington.

Despite the challenges of Covid-19, these 75 companies scored highest among hundreds of employers that participated in Omaha, Nebraska-based Quantum Workplace’s annual employee engagement survey.

The Best Places to Work results are quantitative, based on survey responses from employees themselves, rather than a panel of outside judges. The data doesn’t lie — these companies are scoring points with their workers for perks, leadership, office space, culture and more.

Rankings of the Best Places to Work honorees will be announced at a virtual awards event May 20 and in the May 21 issue of the Washington Business Journal. For more information on the virtual event, click here.

How did these honorees make the list? Nominated businesses meeting criteria for business location and size are invited to participate in employee engagement surveys distributed by Quantum Workplace. Based on the results of those surveys, businesses are assigned a score out of 100 percent and ranked by Quantum. The top-rated companies in four size categories — small, medium, large and extra-large — are honored by the Business Journal as Best Places to Work.

Check out our full list of Best Places to Work winners — in alphabetical order — below.

2021 Best Places to Work

SMALL (10 to 24 employees)

BEI

Capitol Benefits LLC

Capitol Presence LLC

Cope Corrales

Digital Evidence Group LLC

Glassman Wealth Services

Hive Group

Loansteady

Lovelytics

Lurn Inc.

Matrix Consulting

May Construction Group

RLAH Real Estate

SEI

SysArc Inc.

TaylorMade Experience

TorchLight Hire

Vertosoft LLC

VWG Wealth Management

Yoko Co.

MEDIUM (25 to 49 employees)

Capital Brand Group LLC

Case Consulting

Cynet Systems

D&G Support Services LLC

DTS

Immuta

integrateIT LLC

K3 Solutions LLC

M2 Strategy

Nexight Group

Optimal Networks Inc.

Pexip

Public Interest Registry

QBE LLC

Simple Technology

Solutions Inc.

Stratos Solutions Inc.

The Meridian Group

Trustar Bank

Your Part-Time Controller LLC

LARGE (50 to 249 employees)

Anavation LLC

Apex Home Loans Inc.

Booko McAndrews

BTI360

Cassaday & Company Inc.

Century 21 Redwood Realty

Counter Threat Solutions

Expedition Technology Inc.

Expel Inc.

Full Visibility LLC

GuidePoint Security LLC

Harrity & Harrity LLP

iDirect Government

IntraFi Network LLC

John Moriarty & Associates of Virginia

JRC Integrated Systems

MassMutual Greater Washington

MetaPhase Consulting

NextPoint Group

Sequoia Holdings LLC

Seventh Sense Consulting

Significance Inc.

Steward Partners Global Advisory LLC

Valiant Solutions LLC

EXTRA LARGE (250+ employees)

Acuity Inc.

Aronson LLC

Boland

George Mason Mortgage LLC

James G. Davis Construction Corp.

Kearney & Co.

Salesforce

Science Systems and Applications Inc.

Van Metre Cos.

Founder and CEO of Trustar Bank Shaza Andersen Awarded Honorary Doctorate Degree

Granite Mortgage, LLC Announces Name Change to Trustar Mortgage, LLC After Recent Acquisition

Women's History Month Spotlight: Shaza Andersen

Be Courageous, Dream Big, and Have Fun!

Tennis helps people and communities of the Mid-Atlantic grow stronger, healthier, and more connected. It is a lifetime sport that can be played by anyone, anywhere, and is not limited based on gender.

Tennis is one of the few sports in which the earning potential is the same for male and female players. Thanks to the Original Nine, a group of women who broke away from the men’s tour in 1970 in order to take a stand for equal pay, women in tennis top the charts among the highest-earning female athletes according to Forbes Magazine.

There is no shortage of powerful, strong, and influential women in the Mid-Atlantic and many are part of the incredible tennis community in the region. To honor Women’s History Month, we are celebrating those whose passion and drive continue to impact the growth of tennis in the Section. For our next spotlight, we introduce you to Shaza Andersen, a tennis enthusiast, and leader in the local financial and banking industry.

Shaza Andersen is the founder and Chief Executive Officer (CEO) of Trustar Bank. Trustar Bank serves the Greater Washington area and focuses on delivering superior customer service to all members. It is the first Virginia-based bank to be chartered in over a decade.

A sought-after authority on banking and capital market interests, Shaza Andersen has made numerous appearances on channel news stations, has been featured in Forbes Magazine, the Washington Business Journal, and Washingtonian Magazine.

Her accolades do not stop there. She has been recognized as a prominent leader and businesswoman in the Washington, DC area through numerous awards and recognitions such as Top 25 Women to Watch, Top 100 Powerful Women, and Most Admired CEO, to name a few.

Prior to Trustar Bank’s inception, Shaza served as the Vice-Chair of the Board of Sandy Spring Bank and founded and served as CEO of WashingtonFirst Bank. She continues to be a leader in the community, focusing on community service and outreach. Shaza founded the Trustar Youth Foundation (formerly the WashingtonFirst Youth Foundation), a local not-for-profit organization dedicated to enriching the physical, social and mental well-being of children in the Greater Washington area.

Originally from Lebanon, Shaza and her family moved to the US when she was 13 years old and she has been in the Greater Washington area since she was in college. Her commitment to community engagement blossomed soon after that in tennis and her professional endeavors. She started the C3 tennis team at her local tennis club, “[we] enjoyed the competitive and social aspects of the team and the league. Today we play family tennis every Sunday,” Shaza said.

When asked what drew her to the sport, Shaza replied, “I like the opportunity to meet people. It is a game that our entire family can play together and we enjoy that very much.” Now you can find her and her family playing tennis every Sunday at their local club.

We had the opportunity to talk more with Shaza, and she shared her perspective on why it is important to celebrate Women’s History Month based on her experience.

USTA Mid-Atlantic: Why is Women’s History Month important to you?

Shaza: Women’s History Month is important to me as it creates a moment to reflect on the accomplishments of great women in the world and helps to also remind us of the work we have left to do to achieve more.

Who had an impact on your life growing up?

Growing up I’ve had a number of important role models and influencers. My Mom has influenced me so much growing up and over the course of my life. She is a strong independent woman.

What did you want to be when you were growing up?

I thought a lot about being a school teacher growing up. I love children and value education and the impact it has on people.

How would you like to see Women in sports grow?

I’d like to see women’s sports continue to grow by providing meaningful opportunities for women to learn and grow through competition and comradery.

Why is it important for women to play tennis?

It’s important for women to engage, have fun and gain valuable skills through those experiences.

What would you tell another woman or girl interested in playing tennis?

Go for it! Try it out, it’s fun and you’ll have the opportunity to meet a lot of great people in the game.

What does it mean to be a leader in the community?

Being a leader in the community is an opportunity to have an impact and help set an example of what can be achieved.

What was the best piece of advice you received when you were growing up and/or advancing in your career?

Probably one of the best pieces of advice I received when I was growing up and advancing in my career was to have a plan and work that plan each and every day. Having a plan, especially when you’re young, doesn’t mean knowing precisely where you’re headed but it does mean being purposeful in your actions and working and building toward meaningful outcomes. In my professional life, I have always made my plan my priority.

What advice would you like to give to the next generation of women leaders?

Be courageous, dream big and have fun. There are so many opportunities for people who are willing to put in the work to make a meaningful difference in your community.

Women’s History Month is about uplifting women and sharing stories that inspire us all. At USTA Mid-Atlantic, we are inspired by all of our powerful and strong women that make up the Mid-Atlantic tennis community. If you missed any of our spotlight stories, make sure to catch up with Stephanie Evans or Jen Hunter. You can also find spotlights on our Facebook, Instagram, and Twitter and we encourage you to share and join the conversation.

Trustar Bank Announces Full-Service Branch in Great Falls, VA

February 1,2021– GREAT FALLS, VA –(BUSINESS WIRE)

Trustar Bank has announced the opening of a full-service branch at 9883 Georgetown Pike, Great Falls, VA 22066.

This Great Falls Shopping Center location offers clients the convenience and service they have come to know and expect from Trustar Bank, featuring a full-service lobby, convenient drive-through, smart ATM, and Saturday hours.

“Our newest location will allow us to continue to provide exceptional service to Great Falls and its surrounding communities,” commented Shaza Andersen, Chief Executive Officer and Founder.

Great Falls is the third Trustar Bank branch in the Greater Washington market, joining the Reston and Tysons, VA branches.

Since opening in July 2019, Trustar Bank has expanded rapidly with plans to continue a high rate of growth.

About the Bank – Trustar Bank is a full-service bank offering comprehensive banking products and services to small- and medium-sized businesses and consumers. It is the first bank to be chartered and opened in Virginia in over a decade. For more information, please visit Trustar Bank online at trustarbank.com.

Contacts

Shaza Andersen

Chief Executive Officer

sandersen@trustarbank.com

Anthony Fabiano

Chief Financial Officer

afabiano@trustarbank.com

Trustar Bank Acquires Granite Mortgage, LLC

November 4, 2020 GREAT FALLS, VA –(BUSINESS WIRE)–

Trustar Bank announced today that it has acquired Granite Mortgage, LLC (“Granite”). The acquisition provides Trustar with the platform to launch a full-service mortgage business line, broadening the Bank’s depth and breadth of service offerings.

The Fairfax, Virginia based Granite, led by President and Chief Executive Officer Gary Freedman, began serving the DC, Maryland, and Virginia markets in early 2020. “Partnering with Trustar Bank is the next step in Granite’s growth process. As a wholly owned subsidiary of Trustar Bank, Granite will be able to offer our Loan Officers the ability to provide the bank’s unique portfolio loans and expand its lending to new states. We are excited about the opportunity to offer additional loan options including Jumbo Loans, Construction to Perm financing and a true common-sense approach to Portfolio Lending. This new product line is in addition to our current offerings of conventional, FHA and VA loans.” commented Mr. Freedman.

“We are thrilled to offer competitive new residential mortgage programs to our customers. Granite is the right partner at the right time. Gary Freedman has a proven reputation within the local mortgage market and is an effective leader focused on both growth and profitability.” said Shaza Andersen, founder and Chief Executive Officer of Trustar Bank.

Granite Mortgage, LLC will be a wholly owned subsidiary of Trustar Bank. Seasoned mortgage entrepreneur and Trustar Bank Board of Director, Michael Rebibo, will lend his industry expertise as Chairman of the Trustar Mortgage Board. “Having successfully built 1st Portfolio Lending, which sold to WashingtonFirst Bankshares, I understand the benefits of a bank owned mortgage company and the market power of this partnership.” commented Mr. Rebibo. “The dynamic partnership of Trustar Bank and Granite Mortgage, LLC will allow us to provide our customers with residential mortgage programs to meet their home buying and refinancing goals.”

Trustar Bank is a full-service bank offering comprehensive banking products and services to small- and medium-sized businesses and consumers. It is the first bank to be chartered and opened in Virginia in over a decade. For more information, please visit Trustar Bank online at www.trustarbank.com.

Media Contacts

Shaza Andersen

Chief Executive Officer – Trustar Bank

Anthony Fabiano

Chief Financial Officer – Trustar Bank

Gary Freedman

Chief Executive Officer – Granite Mortgage, LLC

Gary.Freedman@GraniteMortgages.com

Trustar Bank buys Fairfax mortgage company, its first acquisition ever

November 4, 2020 –(WASHINGTON BUSINESS JOURNAL)–

Trustar Bank has purchased Fairfax-based Granite Mortgage LLC, expanding the Great Falls bank’s suite of mortgage products, the company announced Wednesday.

Terms of the deal were not disclosed.

Granite Mortgage — its 10 employees in tow — will join Trustar Bank as a wholly-owned subsidiary. The acquisition, which may be Trustar’s first ever, will allow the bank to offer construction-to-permanent financing loans as well as jumbo loans, among other products. Granite Mortgage will be renamed Trustar Mortgage.

The move comes early in the life of the bank, which was founded in 2019 by former WashingtonFirst CEO and founder Shaza Andersen.

“If you were to ask me what would I have done different when I had Washingtonfirst Bank, the answer would be to have a mortgage company earlier in our life rather than later. We waited a long time to buy a mortgage company,” said Andersen, who grew WashingtonFirst to $2 billion in assets before its $447 million sale to Sandy Spring Bank in early 2018. “We decided that we want to do it earlier on in our life rather than later on.”

The purchase allows the bank to capitalize on a hot mortgage market and to increase its fee income as it continues to grow, Andersen said.

Michael Rebibo, Trustar Bank director, will become chairman of a newly-created Trustar Mortgage board, the bank said. Granite Mortgage LLC CEO and president Gary Freedman will continue to lead the subsidiary as president.

Trustar officially opened its doors on July 8, 2019, and now has three branches, having opened one in Reston in June. It had grown to 32 employees and $238 million in assets as of June 30, according to data from the Federal Deposit Insurance Corp. It also delivered about $75 million across 350 forgivable loans under the Small Business Administration’s Paycheck Protection Program, as businesses grappled with the economic fallout of the Covid-19 crisis.

About the Bank – Trustar Bank is a full-service bank offering comprehensive banking products and services to small- and medium-sized businesses and consumers. It is the first bank to be chartered and opened in Virginia in over a decade. For more information, please visit Trustar Bank online at trustarbank.com.

Media Contacts

Shaza Andersen

Chief Executive Officer

Anthony Fabiano

Chief Financial Officer

Renowned Washington Banker Sam Schreiber Joins Trustar Bank

![]()

September 15, 2020– GREAT FALLS, Va.–(BUSINESS WIRE)– Trustar Bank is delighted to announce its partnership with well-known local banking executive, Samuel A. Schreiber. Schreiber’s extensive reputation within the surrounding community compliments the relationship driven approach of Virginia’s first de’novo bank in over a decade. As Senior Advisor for Trustar Bank, Schreiber’s role is focused on opportunity introduction and acquisition.

“As we enter our second year having successfully created a strong structural foundation, while surpassing key milestones, we continue looking forward, identifying opportunities to deepen our impact. Sam’s meaningful community ties will further broaden our reach. We are excited to collaborate with such a highly regarded partner,” commented Shaza Andersen, Chief Executive Officer of Trustar Bank.

Before joining Trustar Bank, Schreiber dedicated 25 years to his career at Wachovia, as well as Wells Fargo after their 2008 merger, holding various roles. At Wachovia, Schreiber acted as Washington D.C. President and Mid-Atlantic Regional President. Schreiber went on to become Regional Executive at Wells Fargo, leading the Mid-Atlantic business banking team to success. Most recently, Schreiber took on the role of President at Chain Bridge Bank, where he oversaw all commercial and consumer business strategy and development activities. In addition, he managed the loan, deposit, and mortgage divisions and joined the Board of Directors of Chain Bridge Bancorp, Inc.

“Business development through relationship building is at the heart of community banking and is something that the Trustar team does very well,” said Schreiber. “I look forward to being a part of a team focused on enriching the experience of clients through exceptional service and forward-thinking solutions.”

Schreiber’s illustrious banking career began in 1975 at Texas Commerce Bank, where he worked as a loan officer. Just seven years later, at age 29, he was named President of Texas Commerce Bank – Campbell Centre. In 1989, he moved on to join First Union, which eventually merged with Wachovia and then later Wells Fargo. In 2013, Schreiber retired from Wells Fargo, beginning his role at Chain Bridge Bank shortly after.

As a former Chairman of the Greater Washington Board of Trade, and member of the board of Inova Hospital Foundation, the Virginia Chamber of Commerce, the Virginia Economic Development Partnership, the Washington Performing Arts Society, and the DC College Access Program, Schreiber knows the importance of taking an active role in his community. In addition, he chaired the Greater Washington Initiative and is an active member of the Economic Club of Washington, D.C. and the Risk Management Association.

Schreiber earned a B.B.A. in Finance from the University of Houston, going on to graduate from the Southwestern Graduate School of Banking at Southern Methodist University and the UNC-Chapel Hill Executive Leadership Program. He lives in McLean, Virginia with his wife, Ellen. The pair has two adult children and three grandchildren.

About the Bank – Trustar Bank is a full-service bank offering comprehensive banking products and services to small- and medium-sized businesses and consumers. It is the first bank to be chartered and opened in Virginia in over a decade. For more information, please visit Trustar Bank online at trustarbank.com.

Media Contacts

Shaza Andersen

Chief Executive Officer

Anthony Fabiano

Chief Financial Officer

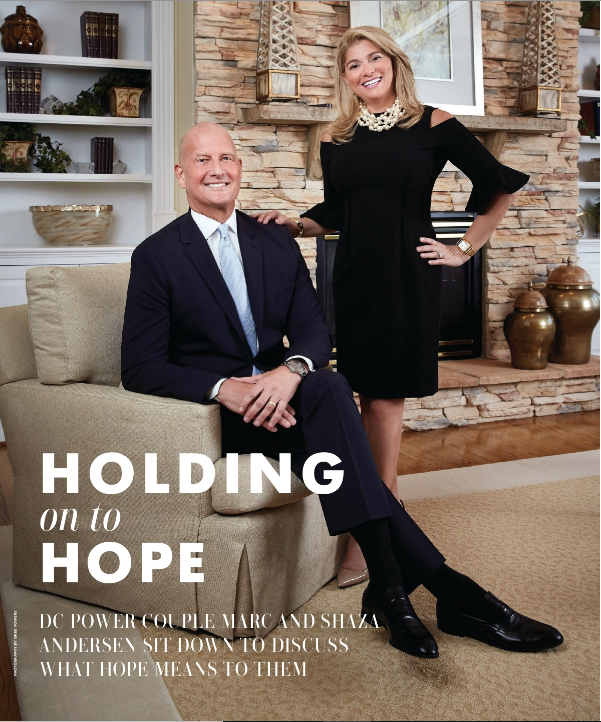

Holding on to Hope: DC Power Couple Marc and Shaza Andersen Sit Down to Discuss What Hope Means to Them

July 20, 2020

Hope Through The Pandemic- Modern Luxury DC Magazine

As individuals that have worked through challenging situations both professionally and personally– what advice would you give our community today?

The pandemic has served as a reminder of how fragile our day-to-day is and has also reinforced the value of human life. It’s important to take time to recognize the opportunity we have to emerge from this a stronger community and nation. Life is about how we respond to challenges. Periods of struggle drive periods of innovation and change. It’s also important to get comfortable with the fact that as we defeat this current challenge, another will come.

We are reminded of American Clergyman Phillip Brooks quote “Pray not for easier times. Pray for stronger men. Do not pray for tasks equal to your powers. Pray for powers equal to your tasks. Then the doing of your work shall be no miracle, but you shall be the miracle.” We need each other now more than ever to be that miracle and we are confident that we’ll pull though and emerge stronger together.

This issue is centered around hope– what brings you hope for the future?

As a family we are grounded in our faith, family and community and each give us hope and confidence for our future. Overcoming the pandemic requires a combination of the strength of our faith and the bond of our families and community to serve one another. Greater Washington is a special place and we remain confident in our ability to leverage our talent and resources to succeed.

The courage and resilience of the American People also gives us great confidence and hope. As we’ve seen from prior periods of struggle, we can be at our best when our backs are against the wall. We are also confident that the unprecedented strength and health of our economy going into this pandemic will provide a strong platform for an accelerated economic recovery. We can also find hope and confidence in our future through the next generation of leaders. In 2019 Marc was appointed by President Trump to serve on the White House Commission on Presidential Scholars. The Commission recently selected the 2020 Scholars class who serve as an example of the incredible talent in our country that is passionate about making a difference for all Americans.

What philanthropic endeavors are you involved in and how has that shaped your view of the world?

We support and invest in organizations and people that focus on children’s health and wellness, promote education and also advocate for veteran and military spouse employment and entrepreneurship. We support the Washington Redskins Charitable Foundation, The Inova Health Foundation, Washington Tennis Education Foundation, Headstrong, The Artists and Athletes Alliance, BourBiz, Flags of Valor, and Hire Military to name a few. Shaza started the Trustar Youth Foundation and Marc serves on the Board. We are focused on supporting the vision of helping children realize their maximum potential regardless of the challenges they may face. We have always believed that we weren’t born for ourselves. In that context, having been intimately involved in many organizations who are the lifeline to those underserved by society, we have come to deeply appreciate the critical importance of philanthropy versus charity. Charity tends to be transactional, while philanthropy is often the reflection of of an emotional connection and sustained commitment to those we are helping.

What do you think is important for us all to remember during these difficult days?

We’ll get through this. While the other side may look and feel different than our lives before the pandemic, keep in mind that it’s also an opportunity. Use this time to develop a new skill and prepare yourself for the innovation that is coming. Our family is spending time together learning a new language, and yes there’s an app for that.

Also– be kind. Kindness matters and there are opportunities every day to be kind. Check-in on a neighbor, help out with groceries for a friend or relative. Mentor and leverage your network for folks searching for a new job. Many families with young children are struggling with schools and summer camps closing, step-in and find a way to help out. And remember to smile.

What inspires you and gives you hope?

Our family, friends, and community inspire us. We’ve also had the great fortune to meet and work with incredible people all around the world and appreciate the difference that people can make together in solving problems and changing lives. We are incredibly motivated and inspired by folks getting up every day working hard to make it happen and think of Roosevelt’s man in the arena; “It is not the critic who counts; not the man who points out how strong the man stumbles, or where the doer of deeds could have done them better. The credit belongs to the man who is actually in the arena, who’s face is marred by dust and sweat and blood; who strives valiantly; who errs, who comes short again and again, because there is no effort without error and shortcoming; but who does actually strive to do the deeds; who knows great enthusiasms, the great devotions; who spends himself in a worthy cause; who at the best knows in the end the triumph of high achievement, and who at the worst, if he fails, at least fails while daring greatly, so that his place shall never be with those cold and timid souls who neither know victory or defeat.”

It’s that American resilience and tenacity, the backbone of our country, that gives us such hope and confidence for the future.

Trustar Bank has continued to grow through the pandemic, delivering $75M in PPP loans

Jun 26, 2020, 2:39 pm EDT

Trustar Bank has had an eventful first year, to say the least.

The Great Falls bank officially opened its doors July 8, 2019, and now has three branches, having just opened one in Reston on June 22. It has grown to 30 employees and $240 million in assets as of May 31. It also delivered about $75 million across 350 forgivable loans under the Small Business Administration’s Paycheck Protection Program, as businesses grappled with the economic fallout the Covid-19 crisis.

The bank’s small staff worked overtime — without being asked — to process the applications as new customers came through the bank’s virtual doors, unable to get loans from their existing banks, said CEO and founder Shaza Andersen.

“I feel blessed that even through the worst of the epidemic that the entire world has been experiencing, our bank has continued to grow and do well,” said Andersen, who had also founded WashingtonFirst Bank, growing it to $2 billion in assets before its $447 million sale to Sandy Spring Bank in early 2018.

Andersen said the bank plans to get to $300 million in assets by the end of 2020.

The pace of growth is much faster than Andersen’s first attempt, she said, which she credited to former customers turning to the small community bank and new customers tired of dealing with larger banks after yearslong consolidation in the industry. The bank rapidly crossed the $100 million asset threshold in in the third quarter of 2019.

“We were pleasantly surprised at the beginning how fast we were able to get our charter and how fast we are able to grow our bank,” Andersen said. “I think they came back a little faster than we had expected.”

The new Reston branch joins existing locations in Tysons and Great Falls. Andersen does not expect to expand that network until 2021, when it will slowly expand into other submarkets across the D.C. metro area, Andersen said.

The bank has slowed its own pipeline of new business, in part from the PPP, Andersen said. Businesses are now beginning to figure out their next steps, and so is Trustar, she added.

Trustar Bank Announces New Branch Location in Reston, VA

9 ways financial organizations are aiding battle against coronavirus

![]()

May 1, 2020- By Allissa Kline

From the start of the novel coronavirus crisis, it became clear that banks had major challenges on their hands yet a real opportunity.

The pandemic dealt a swift blow to public health and economic livelihood, driving many customers (consumers and business owners) into desperate situations and making it harder for bank employees to do their jobs.

Banks insisted that they were not the cause of the financial meltdown this time (unlike a decade ago), that they were highly capitalized by historical standards and that they could help. They obviously realized they had an opportunity to redeem themselves after a decade of withering criticism from politicians, protestors and academics following the Great Recession.

The jury is still out on whether banks have seized the moment. The headlines have not been kind, raising questions about whether lenders dispensing federal aid favored their clients, especially large ones with other means of raising money, over the neediest small businesses. Banking industry officials have been quick to complain about emergency-loan programs and to demand regulatory rollbacks.

However, this cardshow is about the other side of the moral ledger — very creative efforts by banks of all sizes, and nonprofits that work with them, to help clients and the broader public fight for survival amid the pandemic. A community bank in Virginia has steered a portion of fees earned from the Paycheck Protection Program to help medical workers and the hungry; the nonprofit Operation Hope is hiring financial counselors in anticipation of “getting slammed” with requests for advice from the newly unemployed; and CIT Group has helped customers retrofit their businesses to produce personal protective gear for those on the front lines of the crisis.

Here are nine examples of outside-the-box thinking and resourcefulness that could make a positive difference in the country’s time of need.

Trustar redirects some PPP fee income to health care, feeding the hungry

Founder and CEO Shaza Andersen said employees of Trustar Bank in Great Falls, Va., wanted to help out with the coronavirus crisis response. They hit on a different approach, donating a tenth of the fee income the $132 million-asset Trustar earns from its participation in the Paycheck Protection Program to two Washington-area service organizations.

Trustar, a de novo that opened in July, is supporting Inova Health Foundation, which funds medical care and health education, and Washington Nationals Philanthropies, which has focused on combating hunger. “We’re addressing the medical side and the human side of the crisis,” Andersen said.

“There’s a lot of need out there,” Andersen added.

The PPP was created to give small businesses with 500 or fewer employees the means to continue paying workers while the economy is largely idled by the pandemic. Trustar made more than 200 loans to local businesses during the program’s first phase, from April 3 to April 16. The bank picked up where it left off Monday, when the paycheck program resumed. Trustar’s loan count had reached 350 Tuesday afternoon, Andersen said.

“We were here until 2 a.m. working on applications,” Andersen said.

The Small Business Administration, which is managing the PPP, pays a fee for each loan lenders originate, so as Trustar’s loan count ticks up, the funds earmarked for Inova and the Nationals grow.

According to Andersen, “there’s no science” behind the 10% figure in Trustar’s pledge. “We felt 10% was sizable and makes a difference,” she said. — John Reosti

Continue reading the article on AmericanBanker.com

Trustar Bank Donates Portion of SBA Paycheck Protection Program Fees to Local Organizations

![]()

April 27, 2020– GREAT FALLS, Va.–(BUSINESS WIRE)–As a registered lender with the Small Business Administration (SBA), Trustar Bank has utilized the SBA’s CARES Act Paycheck Protection Program (PPP) to provide capital to small businesses, helping them meet their ongoing short-term expenses. The CARES Act, which was signed into law on March 27, 2020, provides banks with an opportunity to assist businesses in need.

In the span of just one week, Trustar Bank has provided over 200 loans to local businesses struggling during the COVID-19 pandemic. As a community bank, Trustar takes great pride in supporting local organizations and important causes. The Bank is happy to announce that they will be donating 10% of PPP processing fees to local organizations, such as the Inova Health Foundation and Washington Nationals Philanthropies. Through efforts like this, Trustar Bank hopes to provide a bit of extra relief to those struggling during these difficult economic times.

“We felt privileged to participate in the SBA’s Paycheck Protection Program (PPP), support the stabilization of the US Economy and help working families in Greater Washington. As a community bank, Trustar Bank understands and values the role that community banks play across this great country,” said Trustar Bank CEO, Shaza Andersen, “To help even further, we are donating 10% of our loan fees from the PPP Program to Inova Health Foundation and the Washington Nationals Philanthropies. It is important to us to serve as strong stewards of our community and invest in programs and people that are committed to making our community healthier, safer and stronger.”

If you would like more information about the Paycheck Protection Program, please visit Trustar Bank’s website at www.trustarbank.com. The Bank’s dedicated PPP Rapid Response Team is ready to assist businesses with any questions they may have.

About the Bank – Trustar Bank is a full-service bank offering comprehensive banking products and services to small- and medium-sized businesses and consumers. It is the first bank to be chartered and opened in Virginia in over a decade. For more information, please visit Trustar Bank online at trustarbank.com.

Local bank to donate portion of its SBA PPP fees to charity

Apr 27, 2020, 12:41pm EDT

Great Falls-based Trustar Bank is donating a portion of the fees it received through the Small Business Administration’s Paycheck Protection Program to charity.

“We felt privileged to participate in the SBA’s Paycheck Protection Program, support the stabilization of the U.S. economy and help working families in Greater Washington,” CEO and founder Shaza Andersen said in a statement to the Washington Business Journal.

The bank will take 10% of its fees generated through the program and give it to the Inova Health Foundation and Washington Nationals Philanthropies, the charitable arms of the Falls Church health system and local MLB team, respectively. Andersen is a board member of the Inova Health Foundation.

Banks receive a fee for each loan processed, based on the size of the loan, under the popular — albeit rocky — SBA forgivable loan program. Trustar Bank said it had processed more than 200 such loans so far.

“It is important to us to serve as strong stewards of our community and invest in programs and people that are committed to making our community healthier, safer and stronger,” Andersen said.

Trustar Bank officially opened its doors this past July and quickly grew to more than $100 million in assets, while also ending the more than 10-year drought on new banks created in the region. It reported about $132 million in assets at the end of 2019. Andersen started up the venture after leading Reston-based WashingtonFirst Bank for 14 years and, ultimately, selling it to Sandy Spring Bancorp Inc. (NASDAQ: SASR) for about $447 million.

“We are really, truly grateful to our community partners like Trustar Bank for coming forward to support their local health system and frontline heroes during this time,” said Sage Bolte, chief philanthropy officer and president of the Inova Health Foundation. “Shaza Andersen has been on the Inova Foundation board and is one of those people that just really tries so hard in incredible ways to do good in the community, and this is just another way.”

Your bank not offering PPP loans? Here are some local banks accepting new customers for the relief program.

The race to apply — and hopefully get approved — for the Small Business Administration’s $349 billion Paycheck Protection Program continues. While some are reporting thy have been approved for the relief program, other small businesses are scrambling to find a bank that will accept their applications.

Many banks require customers have an existing account or business relationship to apply, while others, such as McLean-based Capital One Financial Corp. (NYSE: COF), still haven’t begun accepting applications. And experts agree the first batch of funding is likely to run out, while Congress is at odds over what measures should be included alongside additional funding.

While the agency is not providing official updates, the SBA has authorized 724,000 loans for about $184 billion, according to an email obtained by the Baltimore Business Journal, or more than halfway through the funding currently available.

There are also a number of tips small businesses can employ when applying for their PPP loans, in order to reduce issues and processing time.

But for small businesses left in the lurch, there are local banks accepting new customers, including:

-United Bankshares Inc. (NASDAQ: UBSI), the parent company of United Bank. The regional bank, headquartered locally in McLean, has assets near $20 billion and about 138 branches across Virginia, West Virginia, Maryland, North Carolina, South Carolina, Ohio, Pennsylvania and D.C.

-Southern National Bancorp of Virginia Inc. (NASDAQ: SONA), the parent company of McLean-based Sonabank. Dennis Zember, the bank’s new CEO, said it was receiving inquires about SBA programs from several states away. The bank recently transitioned to new leadership amid an executive reshuffle, and the planned departure of its founders.

–Old Dominion National Bank, a Vienna-based bank that recently absorbed new-bank effort VisionBank’s founders and raised a new round of funding, said it was accepting new PPP customers alongside a new deposit relationship.

–Chain Bridge Bank in McLean also confirmed it was servicing existing clients and taking on new ones for PPP loans.

-Rockville-based Capital Bank said it was flooded with applications in part because it was accepting new customers. The bank has to be more deliberate with new customers as it does its own due diligence, said CEO Ed Barry

-Fairfax’s MainStreet Bancshares Inc. (NASDAQ: MNSB), the parent company of MainStreet Bank, is accepting new customers and has processed about 500 of its businesses so far. CEO Jeff Dick said small businesses need to move their deposits to the bank in order to apply and get their PPP loans processed.

-Great Falls’ Trustar Bank, which first opened its doors in July 2019 to make it the first need bank in the region in more than a decade, is also accepting new customers.

-D.C.-based National Capital Bank is also accepting PPP applications from new clients who are prepared to establish a deposit relationship, said CEO Richard Anderson.

-Fairfax-Based Freedom Bank is also taking on new clients, according to its CEO Joe Thomas, who said in an email that the bank was “working with both clients and prospects in order to best serve the great DC business community and the entrepreneurs who are so vital to ongoing economic growth in the region during this national emergency.”

Mason Alumni Power Couple Committed to Serving Community

Written by Katherine Johnson Dias, George Mason School of Business, on April 13th, 2020.

Since attending and graduating from George Mason University, Marc and Shaza Andersen have embedded themselves in the Washington, D.C., metropolitan area. From establishing careers, marrying, and starting a family, to giving back, the Andersens have achieved several milestones in the region. They are two dedicated community business leaders who recognize the values and impact of the School of Business.

The Andersens serve on the School of Business Dean’s Advisory Council, with Marc also sitting on the Center for Government Contracting Advisory Board, which he helped start.

Most recently, Shaza, BA Area Studies ’89, launched Trustar Bank in July 2019, serving as chief executive officer and founder. Trustar Bank is the first community bank to be chartered in Virginia in more than 10 years.

“With all of the bank consolidations in our marketplace, there was a demand for a new community bank,” she says. The response has been overwhelming.

Previously, Shaza served as vice chair of the board of Sandy Spring Bank and was founder and CEO of WashingtonFirst Bank. She says the team looks forward to growing the bank by delivering superior service and strong returns to shareholders.

Marc, BA Economics ’90, has spent more than 17 years with Ernst & Young LLP (EY). He currently serves as a senior global client service partner advising global technology, public sector, consumer products, and banking and capital market clients. He also served in strategy, public policy, and market leadership roles, to include creating EY’s U.S. federal consulting business.

He has dedicated most of his career to EY because of the people and culture. “EY provides an incredible platform to create and build businesses, grow and develop people, and serve clients globally. It’s fun,” he says.

Marc is passionate about innovation and entrepreneurship, the “key ingredients for driving meaningful change and growth.”

“It’s about understanding what’s possible and then the impact you can make. I’m passionate about bringing the best of the private and public sectors together to solve complex problems by driving innovation and investing in entrepreneurship,” he says.

“We are both committed to doing what we can to help make a difference and to have an impact. Mason has come a long way since we graduated, due in part to alumni and friends staying active and committed to the university’s success,” they say. “From a community perspective, we recognize an opportunity and responsibility to make a difference where we can in the areas that matter most to us: youth, education, and entrepreneurship.”

As board members they recognize the advantages of a Mason business degree and future industry success.

“A degree from Mason’s School of Business sets students apart in what it communicates. The business school does a great job in preparing students to enter the workforce. In addition, as many students work while attending school, it also communicates the ability of Mason students to meet the many demands required to be a successful professional,” say the Andersens.

They encourage students to work hard and make the most of their education and professional development opportunities.

“Understand that success and your career are something that you need to consistently invest in over time. Take risks and do something that you are passionate about and take the time to invest in others and in our community.”

The Andersens look forward to the future and doing more of what they’re passionate about—building their businesses, investing in the community, traveling, and spending time with family and friends.

Marc and Shaza Andersen: The DC Power Couple Have Had a Dramatic Impact on Children’s Lives

Years ago, when Marc and Shaza Andersen met at George Mason University, they began a relationship that would impact the lives of thousands of Washingtonians. “Despite many options to move to other parts of the United States and the world, we’ve never thought twice about leaving,” says Marc, who is the senior global client service partner at EY. “We love Greater Washington. The people, the community, and the opportunities are unlike any other.” The couple has been laser-focused about one thing: Some children in our area need a big assist with health and wellness (they also have a soft spot for veteran and military spouse employment and entrepreneurship). Shaza, who’s the founder and CEO of Trustar Bank, launched the Trustar Youth Foundation (www.trustaryouthfoundation.org), which awards grants and scholarships to organizations dedicated to the betterment of children– whether it’s funding research for the treatment or cure of illnesses that affect youth or providing tuition assistance so kids cans reach their maximum potential. Marc also helped Redskins owner, Dan Snyder, and his wife, Tanya, start the Redskins Charitable Foundation. “We both strongly believe that we were not born for ourselves,” says Marc who was appointed to the White House Commission on Presidential Scholars. “Our work in the community is driven on that belief, and we see how engaged philanthropy is a two-way street. We strive to make a difference in the lives of others, but we are blessed to also be the recipients of what our work returns to us in terms of personal growth and life experiences.”

De Novo Activity Fell in 2019 Despite FDIC Plea

By: Dan Ennis– @Ennis77Dan

The decrease in de novo activity came despite an open plea from FDIC Chairwoman Jelena McWilliams in December 2018 for more effort to open new banks.

“With 14 million American adults without a bank account, we want to see more banks, not fewer,” she wrote in an American Banker op-ed, noting the disappearance of small banks in particular. “Today, 627 counties are only served by community banking offices, 122 counties have only one banking office, and 33 counties have no banking offices at all.”

A November 2019 report by another regulator, the Federal Reserve, reinforced McWilliams’s concerns, highlighting 44 counties — the vast majority rural — that had been “deeply affected” by the closure of more than half of their bank branches between 2012 and 2017.

For its part, the Bank of St. George said it would become, upon opening, the “only locally-headquartered bank” in a community the Census Bureau cited among the nation’s fastest-growing. The bank is Utah’s first de novo since 2007.

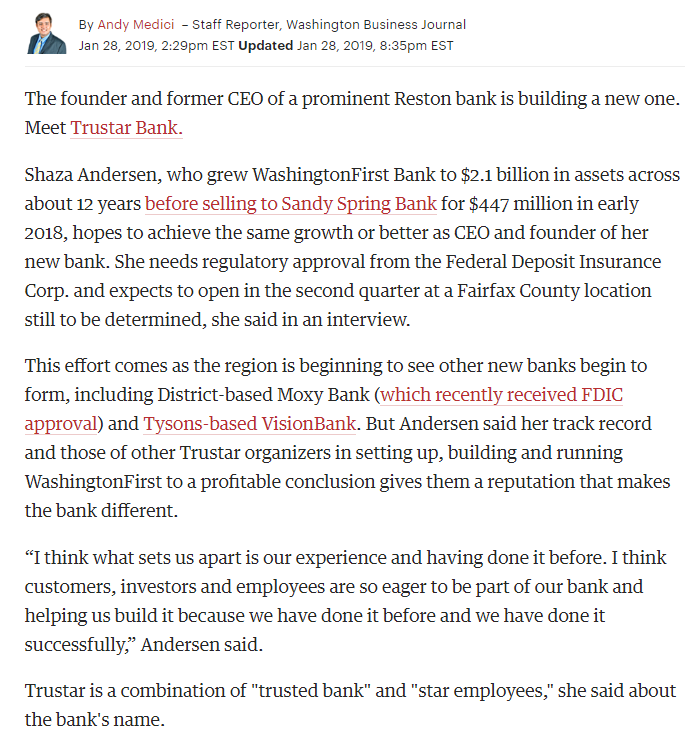

And the executives launching it are veterans of the area. That’s a formula that worked well for another of 2019’s de novos, Great Falls, Virginia-based Trustar Bank. CEO Shaza Andersen rolled out Trustar in July after running WashingtonFirst Bank from 2004 until it was acquired by Sandy Spring Bank in 2018.

Similarly, the Bank of St. George’s CEO, Bruce Jensen, and its president and chief credit officer, West Martin, started and managed Town & Country Bank in St. George from 2008 until it merged with People’s Intermountain Bank in 2017.

Regulatory approval doesn’t guarantee smooth sailing for a de novo. Three of the 15 proposed banks the FDIC approved in 2018 — Community Bank of the Carolinas, Spirit Community Bank and Tarpon Coast Bank — did not open, according to American Banker. Similarly, Silver River Community Bank in Ocala, Fla., which the FDIC approved in 2019, will not open, the agency said.